Best check STUB MAKER

- Instant Online Preview

-

Generate Pay Checks for Payroll

- Instant Download

- Instant Email Preview

- Check Stubs with Taxes

- Paystub with Free Calculator

-

Choose your Own Format

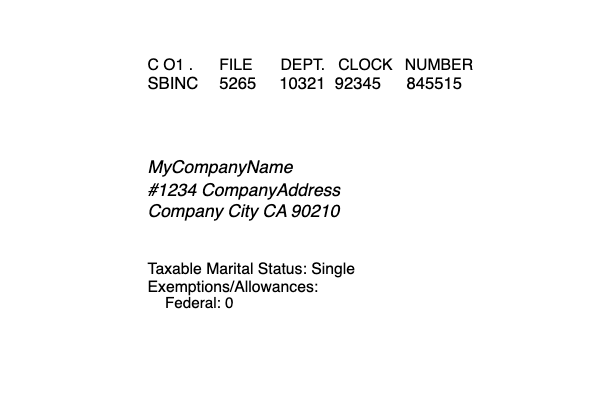

What is a PayCheck stub?

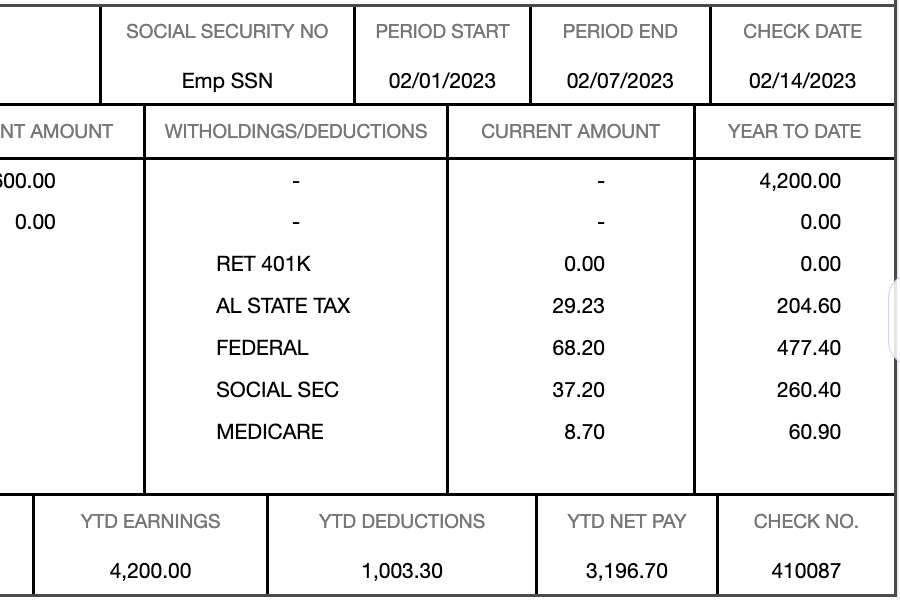

Also known as a salary check stub, payroll slip or PayStub, is a document that accompanies an employee’s paycheck. It provides a detailed breakdown of the employee’s earnings and deductions, including their gross pay, taxes, insurance, and other deductions. Pay stubs serve as proof of income and can be used for tax purposes, mortgage applications, and other financial transactions.

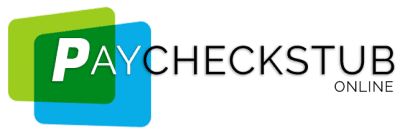

A typical pay stub includes several important pieces of information, including:

- Employee Information: This section of the pay stub typically includes the employee’s name, address, and Social Security number.

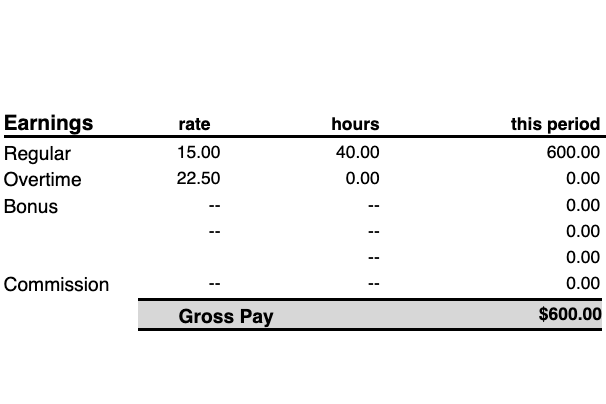

- Gross Pay: This is the total amount of money an employee earned before taxes and other deductions were taken out.

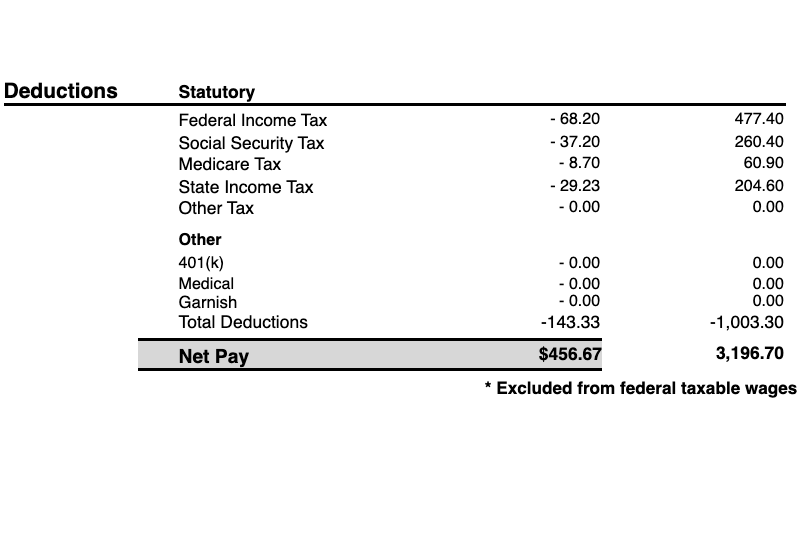

- Deductions: This section includes federal, state, and local taxes, as well as any other deductions that may have been taken from the employee’s pay, such as insurance or 401(k) contributions.

- Net Pay: This is the final amount of money an employee receives after all deductions have been taken from their pay.

PayStub Calculations For Your Business

Our researchers and tax experts have done all the work for you. Simply enter in basic information regarding your employment or employees.

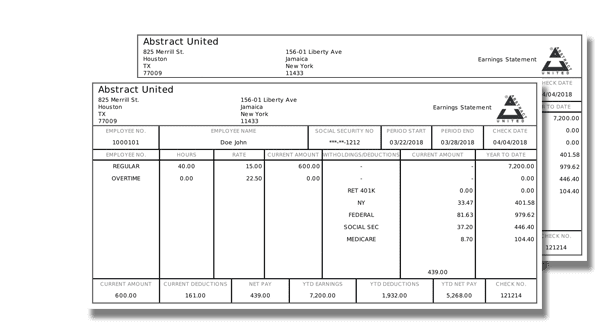

How To Read a PayCheck Stub

Reading a pay stub can seem confusing at first, but it’s actually quite straightforward once you know what to look for. To help you understand your pay stub, here are some tips on how to read it:

EMPLOYEE INFO

Start by looking at the employee information section. Make sure all your personal info is correct and up-to-date.

GROSS PAY

Next, look at your gross pay. This is the total amount of money you earned before taxes and other deductions were taken out.

WITHOLDINGS

Deductions section Will show the amount of money that was taken out for taxes, insurance, and other deductions.

NET PAY

Finally, look at your net pay. This is the final amount of money you will receive after all deductions have been taken from your pay.

Who would I make a PayStub for?

When you have employees, you need to stay on top of changing employment tax rates. Rates impact the amount of money you withhold from employee wages. You can give your employees an electronic or printed paycheck. As a business owner, If an employee suddenly quits or is fired, you might need to pay them quickly.

If you work for yourself, you don’t have an employer to withhold taxes from your paycheck. You have to pay them yourself, including self-employment tax. For example, if you’re a freelancer and you receive 1099 forms at the end of the year, nobody is withholding taxes for you.

Our paystubs are clean and correct. If your employer does not offer paystubs, we can assist in creating paystubs.

Why Are Pay Stubs Important?

Pay stubs are important for a number of reasons, including:

- Proof of Income: Pay stubs provide a record of an employee’s earnings, making them useful for mortgage applications, loan applications, and other financial transactions.

- Tax Purposes: Pay stubs can be used to verify the amount of taxes that have been taken out of an employee’s pay, making them useful for tax purposes.

- Budgeting: Pay stubs can help employees keep track of their earnings, making it easier for them to budget their money.

- Employee Rights: Pay stubs provide important information about an employee’s compensation, making it easier for them to know if they are being paid fairly.

The Components of a Pay Stub

A typical pay stub includes several important pieces of information, including:

- Employee Information: This section of the pay stub typically includes the employee’s name, address, and Social Security number.

- Gross Pay: This is the total amount of money an employee earned before taxes and other deductions were taken out.

- Deductions: This section includes federal, state, and local taxes, as well as any other deductions that may have been taken from the employee’s pay, such as insurance or 401(k) contributions.

- Net Pay: This is the final amount of money an employee receives after all deductions have been taken from their pay.

Pro's

- Proof of Income: Pay stubs serve as a record of an employee’s earnings, making them useful for mortgage applications, loan applications, and other financial transactions.

- Tax Purposes: Pay stubs can be used to verify the amount of taxes that have been taken out of an employee’s pay, making them useful for tax purposes.

- Budgeting: Pay stubs can help employees keep track of their earnings, making it easier for them to budget their money.

- Employee Rights: Pay stubs provide important information about an employee’s compensation, making it easier for them to know if they are being paid fairly.

Con's

- Complexity: Pay stubs can be complex and difficult to understand for those who are not familiar with financial documents.

- Error Prone: Pay stubs can be prone to errors, such as incorrect calculations or incorrect information, which can lead to confusion and misunderstandings.

- Inconvenient: Pay stubs are often delivered with paychecks, which can make it inconvenient for employees to access their pay stubs at other times.

- Cost: Printing and distributing pay stubs can be expensive for employers, especially for large organizations with many employees.

People Also Ask

To make a simple Paystub simply add the basic info of your company and your name address and ssn, Add your wage, pay period length, hours. Then calculate the witholdings/tax deductions, to get your Net Pay. Organize the data in a spreadsheet.

Ideally ours, but any app that allows you simple calculations, and organize employment data such as wage and dates will work. Check for PayStubDirect in the app store.

Yes, you get what you pay for. A good paystub generator will give you the necessary tools to make a professional and accurate paystub, not just a template

Useful Links

Always best to go directly to the source of the legalities regarding Payroll and PayStub details. This helps to understand Payroll Taxes.

As related to Labor and Employment, this could be a good resource when employing others.

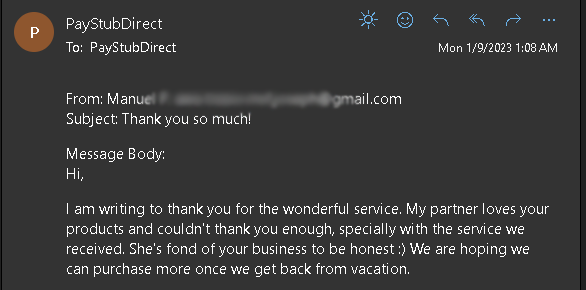

TESTIMONIALS

As Proof of not fake reviews – We screenshot replies. Not just makeup fake stars or made up replies. These are actual screenshots from satisfied Customers since 2006

Another Example

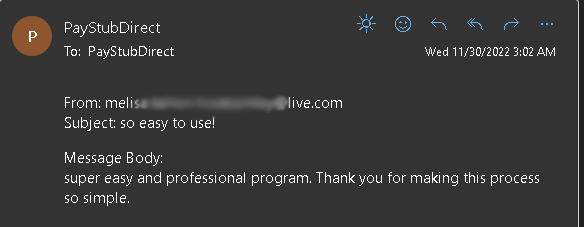

These are all in the past few days. we don’t like to show off, but, proof is proof.,

One More Just in Case...

Another screenshot email, of happy customers. To remove any doubt that we are sincere and ready to help. Even something simple, we are there.