Missouri Pay Stub Generator

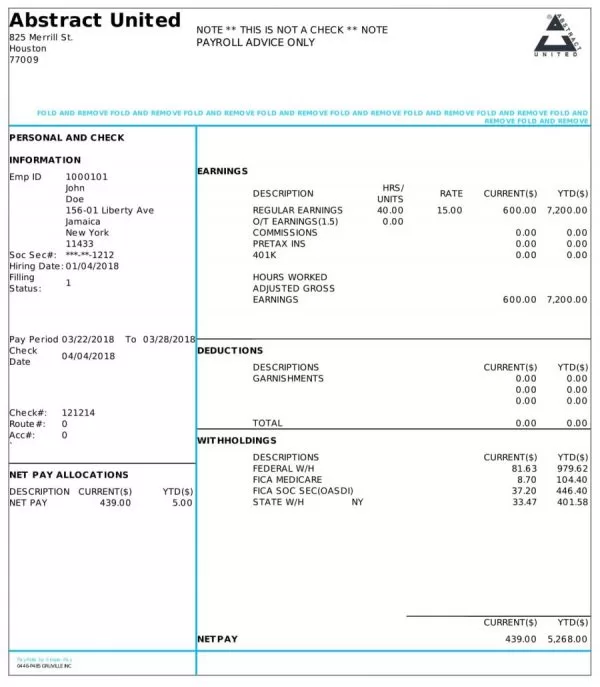

Our Missouri paystub maker eliminates the need for creating paystubs from scratch, whether it’s for furnishing wage statements or presenting proof of income. It’s designed to have a built-in calculator and up-to-date information on Missouri taxes for accurate tax deductions and overall net pay. You can trust in the accuracy of your paystubs when you use our Missouri pay stub generator. Also, you get FREE unlimited previews and can choose from a selection of professional templates. If you need a printed or emailed copy of your Missouri paystub, you can avail of our affordable pricing plans.

Reasons You Should Use Our Missouri Payroll Stub Maker

Accurate

You can guarantee the accuracy of your paystubs with our Missouri paystub generator as it performs calculations on gross pay and net pay with the information you input. Our check stub maker eliminates the need for manual calculation, minimizing the risk of errors on your paystubs.

Affordable

If you want an affordable alternative from hiring a payroll professional or using costly payroll software, then our check stub maker is just what you need. Create Missouri paystubs for as low as $7.95. You can check out our affordable pricing plans for more information.

Easy-to-Use

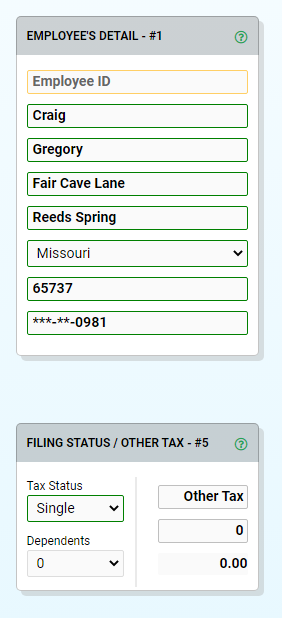

Creating a professional Missouri paystub for employee payroll or proof of income purposes is simple with our paystub maker. All you have to do is enter basic information and salary details on our paystub template and our tool will instantly generate a paystub for you.

Free Paystub Generator for Small Business Owners & Independent Contractors in Missouri

Paystub Generator for Employee Payroll

It’s required by the Missouri Department of Labor and Industrial Relations that any individual or any type of organization which employs one or more individuals to keep true and accurate payroll. The payroll statement should have the following information:

- Name with Social Security

- Place of Employment

- Pay Period

- Gross Wages

- Date Paid

By using our pay stub generator, you can create Missouri paystubs that are compliant with the requirements of the Department of Labor and Industrial Relations with regard to information presented on the paystub. You can guarantee accurate numbers on your Missouri paystub and professional paystub templates. We also have affordable pricing plans for you to avail depending on your business needs and budget.

Paystub Generator for Proof Of Income

When filing for taxes or applying for a loan, institutions in Missouri may require proof of income in the form of paystubs. Independent contractors, who may not have paystubs on a regular basis, may struggle with this requirement. Rather than manually making the paystubs yourself, our Missouri paystub maker can help produce paystubs quickly and easily. By inputting your legitimate basic information and salary details into the paystub template, you can instantly generate paystubs.

Our Payroll Stub Maker Can Deduct Your Taxes Automatically

Our Missouri pay stub generator simplifies the process of calculating taxes by automatically deducting them from your gross pay. Tax deductions are based on the tax status, rate of pay per hour, and state of residence you input. No need to spend time researching Missouri’s tax brackets or manually calculating the tax rate from your gross income.

Know the Individual Income Tax Rate of the State of Missouri

Currently, the individual income tax rate for the state of Missouri is the following:

Taxable Income | Tax Rate |

$0 to $111 | $0 |

At least $112 but not over $1,121 | 1.5% of the Missouri taxable income |

Over $1,121 but not over $2,242 | $17 plus 2.0% of excess over $1,121 |

Over $2,242 but not over $3,363 | $39 plus 2.5% of excess over $2,242 |

Over $3,363 but not over $4,484 | $67 plus 3.0% of excess over $3,363 |

Over $4,484 but not over $5,605 | $101 plus 3.5% of excess over $4,484 |

Over $5,605 but not over $6,726 | $140 plus 4.0% of excess over $5,605 |

Over $6,726 but not over $7,847 | $185 plus 4.5% of excess over $6,726 |

Over $7,847 but not over $8,968 | $235 plus 5.0% of excess over $7,847 |

Over $8,968 | $291 plus 5.3% of excess over $8,968 |

Create Professional Paystubs with Our Missouri Pay Stub Generator

PayCheck Stub Online is an efficient and user-friendly solution for businesses looking to simplify their payroll process or for self-employed individuals in need of quick and easy Missouri paystubs for proof of income. It quickly generates professional and accurate paystubs for Missouri employees and complies with the Department of Labor and Industrial Relations requirements for paystub information.

It is also cost-effective, eliminating the need for expensive accounting software or hiring a payroll specialist. It’s simple to use for anyone, including those without knowledge of payroll or accounting. If you need a fast and easy tool for creating your Missouri paystubs, PayCheck Stub Online is the app you’re looking for.

Get free unlimited previews and affordable PDF copies. Don’t wait any longer and try it out today.